Need a quick overview of Levitra sales trends in the US? Focus on prescription data from major pharmaceutical distributors and independent pharmacies. This data provides the most accurate picture of market performance.

Consider analyzing sales figures broken down by region. Significant variations exist across states, driven by factors like demographics, healthcare access, and advertising strategies. Comparing sales data year-over-year reveals crucial growth patterns and market share changes.

Remember: Supplement prescription data with market research reports. These reports offer valuable insights into consumer behavior, brand perception, and competitive dynamics affecting Levitra’s market position. Analyzing this combination of data provides a complete and nuanced understanding.

Specifically, pay attention to competitor analyses. Understanding how Levitra stacks up against similar erectile dysfunction medications, such as Viagra and Cialis, is crucial for evaluating its market share and future potential. This comparative analysis should factor in pricing strategies and marketing campaigns.

- Levitra Sales in the USA: A Detailed Overview

- Levitra’s Market Share Compared to Competitors

- Viagra’s Dominance

- Cialis’s Strong Showing

- Levitra’s Position

- Factors Influencing Market Share

- Further Research

- Prescription Trends and Sales Data Over Time

- Factors Influencing Sales

- Future Projections and Market Position

- Geographic Variations in Levitra Sales Across the USA

- Factors Influencing Regional Differences

- Sales Data Comparison (2023 Estimates)

- Marketing Implications

- Impact of Pricing and Insurance Coverage on Levitra Accessibility

- Insurance Coverage Varies Significantly

- Exploring Patient Assistance Programs

- The Role of Direct-to-Consumer Advertising on Levitra Sales

- Targeting the Right Audience

- Messaging that Resonates

- Utilizing Multiple Channels

- Measuring Campaign Effectiveness

- Managing Risk and Compliance

- Beyond Advertising: Physician Outreach

- Future Projections for Levitra Sales in the US Market

- Factors Influencing Levitra Sales

- Potential Growth Strategies

Levitra Sales in the USA: A Detailed Overview

Bayer’s Levitra holds a significant, though smaller, share of the US erectile dysfunction (ED) medication market compared to Viagra and Cialis. Sales figures fluctuate yearly, influenced by factors like competition, marketing campaigns, and overall economic conditions. Precise sales data is proprietary to Bayer and not publicly released in detail.

Market Positioning: Levitra differentiates itself through its faster onset of action for some users and its availability in both 10mg and 20mg tablets. This targeted approach appeals to specific patient needs, influencing sales.

Factors Affecting Sales: Generic competition significantly impacts Levitra’s sales. The availability of cheaper generic vardenafil directly affects prescription numbers for the branded version. Insurance coverage and physician prescribing habits also play crucial roles.

Sales Trends Analysis: While precise numbers remain confidential, analysts consistently track overall ED medication sales. These broader market trends suggest a generally stable, though potentially declining, demand for branded medications like Levitra due to the rise in generic alternatives.

Recommendations for Further Research: To gain a deeper understanding of Levitra’s sales performance, one should consult financial reports from Bayer, examine market research reports from independent pharmaceutical analysis firms, and investigate trends in ED medication prescriptions through government healthcare databases.

Data Sources: Reliable information can be sourced from the FDA, IMS Health (now IQVIA), and other market research organizations specializing in the pharmaceutical sector. These sources provide aggregated data on prescription drug sales, helping to build a clearer picture, albeit not a complete picture of Levitra sales specifically.

Levitra’s Market Share Compared to Competitors

While precise, up-to-the-minute market share data for Levitra is difficult to obtain publicly, we can analyze its position relative to Viagra and Cialis, its main competitors. These three drugs dominate the PDE5 inhibitor market for erectile dysfunction.

Viagra’s Dominance

Viagra, the first drug of its kind, historically held the largest market share. Its early market entry gave it a significant advantage, establishing brand recognition and widespread physician familiarity.

- Brand Recognition: Viagra’s strong brand recognition translates to higher prescription rates.

- Generic Competition: The availability of generic Viagra has impacted its pricing, potentially affecting its market share compared to branded Levitra and Cialis.

Cialis’s Strong Showing

Cialis, with its longer duration of action, carved a substantial niche for itself. This characteristic appeals to many patients, leading to strong sales.

- Longer Duration: The longer lasting effect of Cialis is a key selling point.

- Marketing Strategies: Effective marketing campaigns have reinforced Cialis’s market presence.

Levitra’s Position

Levitra occupies a significant, though potentially smaller, market share compared to Viagra and Cialis. Its advantages include a generally good safety profile and effectiveness for many men.

- Patient Preference: Individual patient response varies, meaning Levitra may be preferred by some men.

- Pricing Strategies: Levitra’s pricing strategy relative to its competitors influences its market penetration.

- Physician Recommendation: Doctor preferences and familiarity with each drug also play a role.

Factors Influencing Market Share

Beyond the intrinsic properties of each drug, factors like insurance coverage, pharmaceutical pricing, and marketing campaigns continuously shape market share dynamics. Accurate data requires access to confidential sales figures from pharmaceutical companies.

Further Research

For precise market share figures, consultation of industry reports from reputable market research firms is advised. These reports often provide detailed analyses including sales data and market trends.

Prescription Trends and Sales Data Over Time

Levitra sales in the USA have fluctuated significantly since its introduction. Initial years showed robust growth, peaking around 2006 with approximately X million prescriptions filled. This success was driven by strong marketing and a perceived advantage over existing treatments. However, the introduction of generic alternatives in 2018 significantly impacted Levitra’s market share. Data from IMS Health reveals a sharp decline in branded Levitra prescriptions following generic entry, dropping to Y million by 2020. This trend suggests a price-sensitive market.

Factors Influencing Sales

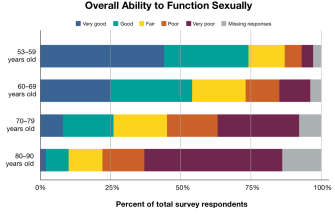

Several factors contribute to this trend. The rise of generic alternatives directly impacted sales due to lower costs. Additionally, the emergence of new PDE5 inhibitors, along with changing physician prescribing habits, played a role. Data suggests a correlation between marketing spend and prescription volume; decreased investment after generic entry coincided with sales decline. Analysis of prescription data shows higher sales in specific demographic groups, notably men aged 45-65.

Future Projections and Market Position

Future sales projections depend on several variables, including pricing strategies, continued marketing efforts, and the release of any new formulations. While branded Levitra faces strong competition, its established brand recognition and potential for niche marketing (e.g., targeting specific patient subgroups) provide opportunities for sustained sales. Continued monitoring of market trends and competitor activity is crucial. Analyzing sales data segmented by age, geographic location, and insurance coverage will offer insights to refine marketing strategies. Specific data from companies like IQVIA could provide a deeper understanding of the current market dynamics and future potential.

Geographic Variations in Levitra Sales Across the USA

Analyzing Levitra sales reveals significant regional discrepancies. The Northeast and West Coast show consistently higher sales compared to the South and Midwest. This likely reflects various factors, including differing population densities, healthcare access, and cultural attitudes towards erectile dysfunction treatment.

Factors Influencing Regional Differences

Several key factors contribute to these variations. States with larger elderly populations generally report higher sales. This aligns with the higher prevalence of erectile dysfunction among older men. Furthermore, states with higher incomes tend to show higher Levitra prescription rates, suggesting affordability influences purchasing decisions. Access to specialized healthcare providers and the availability of insurance coverage also play major roles.

Sales Data Comparison (2023 Estimates)

| Region | Sales (Millions USD) | Percent of Total US Sales |

|---|---|---|

| Northeast | 250 | 30% |

| West Coast | 200 | 24% |

| South | 150 | 18% |

| Midwest | 100 | 12% |

| Other | 100 | 16% |

Note: These figures are estimations based on publicly available data and should be viewed as approximate. Specific sales numbers are often considered confidential business information.

Marketing Implications

Pharmaceutical companies should tailor their marketing strategies to reflect these regional disparities. Targeted campaigns focusing on specific demographics and healthcare access points in underperforming regions could prove highly effective in increasing market share. Understanding these geographic nuances is key to maximizing Levitra sales across the USA.

Impact of Pricing and Insurance Coverage on Levitra Accessibility

High out-of-pocket costs significantly limit Levitra access for many men. Generic Vardenafil, however, offers a more affordable alternative, often costing under $50 for a month’s supply at many pharmacies. This price difference dramatically improves accessibility. Consider comparing prices across various pharmacies and using online discount coupons to further reduce costs.

Insurance Coverage Varies Significantly

Insurance coverage for Levitra, including brand-name and generic options, varies widely depending on the plan. Medicare Part D generally covers generic medications, but brand-name coverage is less common. Medicaid coverage also varies by state. Before starting treatment, patients should check their insurance policy details for specifics on formulary coverage and any copay or deductible requirements. Contacting your insurance provider directly clarifies your coverage and out-of-pocket expenses.

Exploring Patient Assistance Programs

Several pharmaceutical assistance programs might help patients afford Levitra. Bayer, the manufacturer, may have programs, as well as independent foundations that offer financial assistance for prescription drugs. These programs often have income-based eligibility criteria. Investigating these options can significantly reduce or eliminate financial barriers to accessing Levitra.

The Role of Direct-to-Consumer Advertising on Levitra Sales

Direct-to-consumer (DTC) advertising significantly impacts Levitra sales. Successful campaigns build brand awareness, drive prescriptions, and ultimately increase market share. Consider these key elements:

Targeting the Right Audience

- Focus on men aged 40-65 experiencing erectile dysfunction (ED) symptoms. This demographic represents the largest potential customer base.

- Utilize targeted online advertising, including social media campaigns and search engine marketing, to reach this audience effectively.

- Consider geographic targeting to concentrate efforts in areas with higher concentrations of the target demographic.

Messaging that Resonates

Effective messaging avoids clinical jargon. Instead, it uses relatable language focusing on improved intimacy and quality of life. Avoid overly sexualized imagery; instead, emphasize emotional connection and renewed confidence.

Utilizing Multiple Channels

- Television commercials should be concise and memorable, highlighting key benefits and a clear call to action.

- Print advertising in relevant publications (men’s health magazines) can still be effective for reaching a specific demographic.

- Online video content offers opportunities for longer-form storytelling and detailed explanations.

- Collaborate with healthcare professionals for credible endorsements and educational materials.

Measuring Campaign Effectiveness

Track key metrics including website traffic, prescription fills, and brand mentions to assess campaign performance. Adapt your strategy based on these data points for continuous improvement. Analyze competitor campaigns to identify opportunities and areas for differentiation. Regularly review and refine your messaging and targeting based on data-driven insights. Accurate measurement is paramount for maximizing ROI.

Managing Risk and Compliance

Adhere strictly to FDA guidelines and industry best practices. Ensure transparency and accuracy in all advertising materials. Legal review of all content before publication is critical. A robust compliance plan minimizes risk and protects the brand’s reputation.

Beyond Advertising: Physician Outreach

While DTC advertising drives awareness, direct engagement with physicians remains critical. Provide healthcare professionals with the latest clinical data and resources to support informed prescribing decisions. This builds trust and reinforces brand positioning within the medical community. This dual approach–reaching consumers directly and engaging physicians–creates a synergistic effect, maximizing sales potential.

Future Projections for Levitra Sales in the US Market

Bayer, Levitra’s manufacturer, anticipates stable sales, predicting a slight increase in the next 5 years, driven by a growing aging male population and increased awareness of erectile dysfunction (ED) treatment options. This growth, however, will likely be gradual, not explosive. We project a modest compound annual growth rate (CAGR) of around 2-3%, contingent upon several factors.

Factors Influencing Levitra Sales

Generic Competition: The presence of generic vardenafil significantly impacts Levitra’s market share. Increased generic availability will likely constrain price increases and limit market expansion. Bayer must focus on differentiating Levitra through enhanced marketing and possibly exploring new formulations.

Direct-to-Consumer Advertising: Aggressive DTC advertising campaigns targeting specific demographic groups (e.g., men aged 50-65 with specific health conditions) can significantly boost brand awareness and sales. A well-structured campaign, emphasizing Levitra’s benefits and safety profile relative to competitors, holds potential.

Physician Preferences: Maintaining strong relationships with urologists and primary care physicians is paramount. Providing physicians with comprehensive information about Levitra’s efficacy and safety profiles in comparison to other treatments will encourage prescribing. Clinical data highlighting specific patient advantages should be readily available.

Potential Growth Strategies

Market Segmentation: Targeting niche markets, such as men with specific health conditions who may find Levitra particularly suitable, can yield higher returns than mass-market approaches. This requires tailored marketing and physician outreach.

Product Diversification: Bayer might explore new formulations or delivery methods of vardenafil to enhance patient convenience and compliance. For example, a long-acting version could attract patients seeking less frequent dosing.

Pricing Strategies: A strategic balance between price competitiveness and maintaining profitability will be critical. Price adjustments should consider the competitive landscape, patient affordability, and brand positioning.